For many people, a mortgage is one of the largest loans they’ll take out in their lifetime. Whether it’s your first or fourth time buying a home, navigating the different mortgage options can be overwhelming. It’s not a decision homebuyers should make lightly.

To help take some of the stress and confusion out of the equation, we’re breaking down the 5 most common types of mortgages. Let’s find what works best for you so you can secure the home of your dreams!

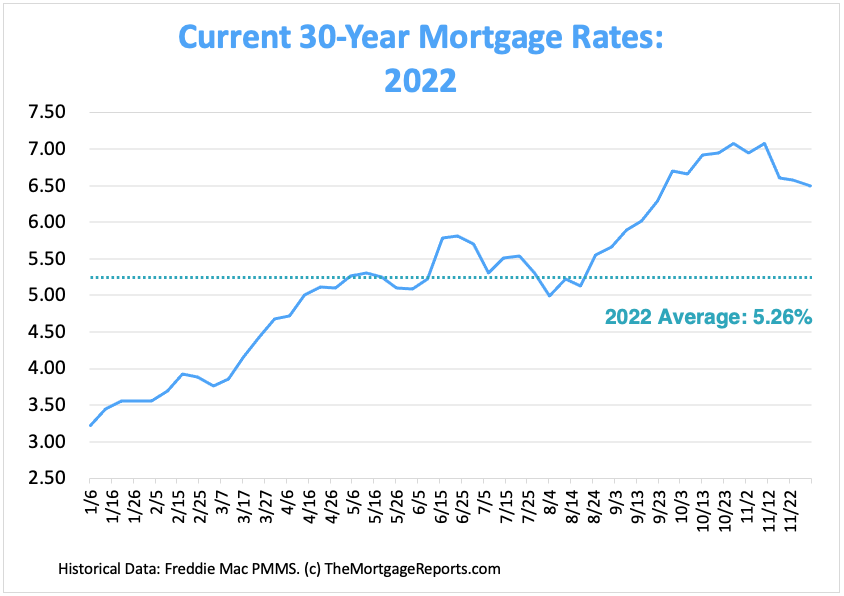

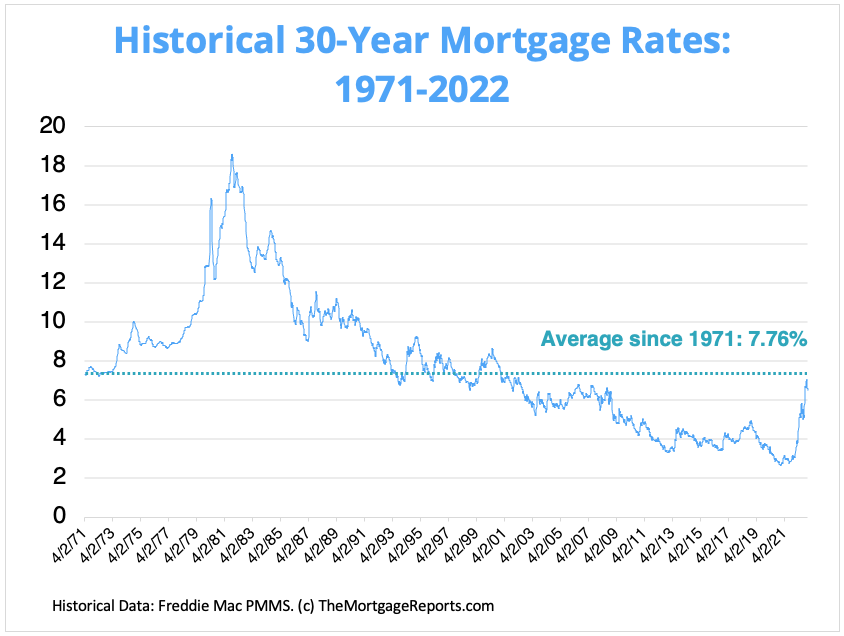

Mortgage Rates: The Bigger Picture

We can’t talk about mortgages without first talking about mortgage rates. Simply put, a mortgage rate is the rate of interest on your mortgage loan, given as a percentage.

Source: Freddie Mac

Source: Freddie Mac

As we enter 2023, mortgage rates are at the forefront of every buyer’s mind. After hitting record lows in 2020 and 2021, rates increased steadily throughout 2022 as inflation surged. The rising rates have many potential buyers concerned about the affordability of homes and how it will affect the housing market in the coming year.

Source: Freddie Mac

Source: Freddie Mac

However, it’s comforting to zoom out and look at the bigger picture. Although rates have been rising, current rates in Iowa (hovering between 5–6% at the time of writing) are still below the historical 50-year average of 7.76%, and much lower than the all-time high of 18.4%, set in 1981.

In other words, it’s important to remember that what many people consider a ‘normal’ rate has been skewed by the unusually low numbers we’ve enjoyed in recent years. In fact, real estate experts don’t foresee 2023 as a year of a housing crisis. Rather, they foresee it as a year of returning to normalcy—true normalcy—in the market.

Common Mortgage Types

Now that we have some historic context for mortgage rates, let’s dig into the most common types of mortgages our agents encounter when working with buyers.

Fixed-Rate Mortgages (FRMs)

A fixed-rate mortgage is a mortgage loan where the interest rate stays the same for the duration of the loan. This means your monthly payment and mortgage rate don’t change for the entire lifetime of the loan.

Loan Terms

Fixed-rate mortgages come in different loan lengths. 15-year fixed and 30-year fixed are the most common, though 10- and 20-year fixed mortgages are offered by some lenders. The only difference between these options is the term (or duration) of the loan.

With a 15-year fixed mortgage, your monthly payment is higher, but you pay interest over a shorter span of time, meaning you pay less money on the loan overall.

With a 30-year fixed mortgage, your monthly payment is lower, but the loan is drawn out over a longer period of time, meaning you will ultimately pay more in monthly interest over the lifetime of the loan.

However, just because you have a 30-year mortgage does not mean you need to take the full 30 years to pay it off. If you’re able to pay the loan off sooner, you can reduce the amount of interest you pay in the long run.

Pros and Cons

Whether you opt for a 15- or 30-year fixed-mortgage, the main advantage is the same: predictability. With a fixed-rate loan, your interest will be the same in year one, year 10, and year 22. This security and stability is what makes fixed-rate mortgages the most popular type of mortgage in the United States.

However, there are certain aspects of your fixed-rate mortgage payments that will fluctuate over time. To understand what costs will and won’t be “locked-in,” you first need to understand what goes into your monthly mortgage payment. Each payment is made up of four expenses:

- principal (the amount that pays down your loan)

- interest (based on the interest rate at the time of the loan)

- property taxes

- mortgage insurance (note: not every loan requires mortgage insurance)

While your principal and your interest will never change, taxes and insurance costs are subject to change in a fixed-rate mortgage. However, these cost adjustments won’t be made without advance notice, so you won’t be caught off guard by any potential extra expenses.

Escrow

While we’re on the subject of taxes and insurance, let’s talk about escrow.

Once you purchase a home, an escrow account will be set up. The property tax and mortgage insurance portions of your monthly mortgage payment are held in this escrow account. When your property taxes and mortgage insurance payments come due, the bill is paid automatically from this escrow account. This ensures your payments are always on time.

Each year you will receive an annual accounting, which shows the balance of your escrow account and the amount you paid that year for taxes and insurance. This annual accounting also includes an estimate for how your property taxes and insurance bill will change in the coming year (if it is changing). This is the ‘advance notice,’ we mentioned above.

Despite these fluctuations in taxes and insurance, your fixed-rate mortgage guarantees more stability in your monthly payments than any other type of mortgage. Just be sure to budget accordingly for any changes in your escrow!

Refinancing

Fixed-rate mortgages are most common when rates are low—if you locked in a 30-year fixed rate in 2020 at 3%, your interest rate will remain at 3%, even as rates rise.

What happens if you locked in when rates were higher, but now rates have plummeted? For example, what if you bought your home with an 8% 30-year-fixed mortgage, but want to take advantage of the lower mortgage rates we’ve seen recently?

Luckily, you’re not stuck in your fixed-rate mortgage for eternity. You have the option to refinance, which means getting a new mortgage loan to replace your existing mortgage loan.

Most people refinance to save money, whether that means securing a lower mortgage rate or shortening the length of their loan. Not surprisingly, nearly 25% of all homeowners refinanced in 2021 to capitalize on the extremely low rates.

This is also where the catchy saying, “marry the house, date the rate,” often comes into play. You may be making a long-term commitment to your home, but you can always “dump” your current rate for a new one!

Adjustable-Rate Mortgages (ARMs)

On the flip side of the mortgage coin is adjustable-rate mortgages (or ARM). An ARM is a mortgage loan where you will pay a fixed interest rate for an initial period of time; after that set period, your mortgage interest rate will adjust based on the market.

The Fixed Period

In an adjustable-rate mortgage, the initial period of time in which your rate is fixed can range from six months to 10 years. During this time, your interest rate will typically be lower than that of a fixed-rate mortgage. This means smaller payments at the beginning of your loan term—one of the major appeals of an adjustable-rate mortgage.

The Adjustable Period

After this initial, fixed-rate period, your interest rate is subject to change on a regular, pre-defined basis for the remaining duration of the loan. The rate adjusts based on two numbers: an index and a margin. The margin + the index = your variable interest rate.

The index is a benchmark interest rate that is determined by the current state of the market. When the market changes, so does this index. What specific index your rate is based on is chosen by your lender. If you’re considering an ARM, be sure to ask your lender what index they will be using.

The margin is a set number of percentage points that is added to the index. The margin amount is determined when your loan is created and does not change throughout the life of your loan. A typical margin is often 2–3%.

Note that this variable interest rate is not limitless. Most ARMs have a cap on what your interest rate can be to offer some financial protection.

Loan Terms

One of the most common types of adjustable-rate mortgages is a 5/1 ARM. This means your rate is fixed for the first five years of your loan, after which your interest rate will become variable and is subject to change once a year for the remainder of the loan term. Similarly, a 10/1 ARM would mean 10 years of a fixed interest rate, after which your rate will change once per year.

A 5/5 ARM, on the other hand, would have a fixed period for the first 5 years, and your rate would adjust every 5 years after that.

Pros and Cons

One of the major advantages of an adjustable-rate mortgage is the lower, fixed interest rate during those first few months or years.

The biggest drawback, of course, is the unpredictability of your rate after that fixed period. It can be hard to budget for your mortgage payment when your interest rate is in a state of flux. The factors that determine the rate—the index and the margin—are unfortunately out of your control. You could end up with smaller payments should interest rates go down, or you could end larger payments if interest rates continue to rise.

It’s a risk many homeowners aren’t willing to take. Because of this, adjustable-rate mortgages work best in short-term loan scenarios. Examples include:

- Buyers who plan to move again in the next 5–10 years and will likely sell before they reach the adjustable rate period of the loan.

- Buyers who plan to refinance sooner rather than later—before the initial fixed period ends.

- Buyers who plan to pay off the entirety of the loan within the fixed-rate period.

In all of these scenarios, the key money-saving strategy is capitalizing on the low interest rate during the initial fixed period.

Fixed-Rate vs. Adjustable-Rate

Should you go with fixed-rate or an adjustable-rate mortgage? When weighing your options, it ultimately comes down to predictability and flexibility. Fixed-rate mortgages are predictable, but inflexible (unless you refinance). Adjustable-rate mortgages are flexible, but unpredictable.

Your financial situation and your future plans will determine which of these mortgages is right for you. Don’t forget to ask your lender and your Urban Acres agent for their advice!

VA Home Loans

VA home loans are mortgages backed by the Department of Veterans Affairs. VA loans are not offered through the government directly; rather, they are offered through private lenders and banks and then funded by the government.

Who is the VA loan for?

Only qualifying service members, veterans, and surviving spouses are eligible for VA loans. The goal of the VA loan is to make home buying easier and more affordable for those who have served our country.

There are several subtypes of VA loans, almost all of which require a Certificate of Eligibility (COE). This is usually obtained online or through your lender and is based on factors like what branch of the military you served in and how long you served.

Pros and Cons

Because they are available only to a select few, VA mortgages come with many perks. A few of the more notable benefits include:

- No down payment required (in most cases)

- No private mortgage insurance (PMI) required, as it sometimes is for conventional (non-government-backed) loans

- Low, competitive interest rates

- Little to no closing costs

- VA loans may be assumable by another veteran

VA loans are also a life-long benefit, meaning you can use multiple VA loans throughout your lifetime.

These significant savings have a slight cost attached, however. Those who take out VA mortgages are required to pay a VA funding fee to the Department of Veterans Affairs. This one-time fee is meant to alleviate the cost of the loan for taxpayers—a tradeoff for the money saved on PMI and closing costs.

VA funding fees range from 0.5% to 3.6% of the home’s purchase price, with 2.3% being the average. The exact amount is determined by the:

- type of VA loan you are taking out

- the amount of your loan

- whether or not it’s your first time using a VA loan

- the amount of your down payment.

In general, the greater your down payment, the lower your VA funding fee will be.

There are a handful of situations in which you may be exempt from the funding fee, so be sure to ask your lender.

Rural Development (RD) Loan

A rural development home loan is a type of mortgage backed by the United States Department of Agriculture (USDA). Because of this, they are sometimes referred to as USDA loans. As the name suggests, RD loans were founded with the intention of increasing homeownership in less populated areas of the country.

Who is the RD loan for?

Unlike other mortgages, RD loans are restricted based on both the buyer and the property.

Buyer eligibility is determined by income; this loan is specifically designed for low- and moderate-income buyers. The best way to determine if you qualify is to work with your lender.

For a property to be eligible, it must be located in a community that has a population of 20,000 or less. There are qualified towns in all 99 counties in Iowa!

In the Corridor, every town aside from Iowa City, Cedar Rapids, and Coralville has a small enough population to be eligible. That includes:

- North: North Liberty, Mount Vernon, Lisbon, Solon, Swisher, and Shueyville

- South: Hills, Kalona, Lone Tree, Riverside, Wellman, and Washington

- East: West Branch and West Liberty

- West: Amana, Oxford, Tiffin, and Williamsburg

Last but not least, RD loans are only for owner-occupied homes. If you buy a property with an RD loan, it must be your primary residence. Investment properties or vacation rentals do not qualify.

Pros and Cons

RD loans have some of the best benefits of any mortgage on the market, largely on par with VA loan benefits. That’s because both loan types are backed by the government, protecting lenders from potential losses.

RD loans are 100% financed, meaning no down payment on the property is required. They also have below-market interest rates—typically some of the lowest available. Finally, RD loans are fixed-rate only, meaning you’ll always know exactly what your monthly payment is.

As with the VA loan, however, RD loans come with a mandatory fee, called a guarantee fee, which ensures that the lender is protected should the buyer default on their mortgage payments. The guarantee fee is split into two parts: an upfront fee and an annual fee.

The upfront fee is a flat 1% of the total loan amount. Despite its name, it doesn’t technically have to be paid up front at the time of closing. Many buyers choose to roll the cost into their overall loan amount.

The annual fee is 0.35% of the current loan balance, which is paid throughout the year. Again, the name is a bit misleading—rather than paying once per year in a lump sum, the annual fee is automatically added onto your monthly mortgage payment, paid in 12 installments throughout the year.

Federal Housing Administration (FHA) Loan

An FHA mortgage is a mortgage insured by the Federal Housing Administration. Like the VA loan and the USDA loan, FHA loans are non-conventional, meaning they are backed by the government. Because the loan is bankrolled by the federal government, your lender can give you a better deal.

Who is the FHA loan for?

FHA mortgages are designed for people who may have trouble getting a home loan otherwise due to low credit scores, debt, or other financial factors. Generally speaking, they are easier to qualify for than conventional mortgages (loans not backed by the government).

FHA loans are meant for primary residences only, meaning investment properties or second homes do not qualify.

Similar to USDA loans, FHA mortgages are restricted based on the property itself. Homes that are being considered for an FHA loan must pass an inspection to ensure the property meets certain safety and security standards and is in a condition that befits the selling price. This inspection is done by a property appraiser who has been approved by the Housing and Urban Development (HUD) department of the federal government.

Pros and Cons

FHA loans offer many of the same benefits as other government-backed loans, including smaller down payments and a looser credit requirements. All FHA loans are fixed-rate, so your monthly payments will be the same for 15 or 30 years—nice and predictable!

However, to protect the government if the homebuyer should default on the loan, borrowers are required to pay FHA mortgage insurance. Like the guarantee fee for USDA loans, FHA mortgage insurance is split into two parts: an upfront mortgage insurance premium (UFMIP) and an annual mortgage insurance premium (AMIP).

The upfront mortgage insurance premium is 1.75% of the total loan amount. This amount is charged at the time the loan is granted, but can be rolled into the total loan amount and paid over time.

The annual mortgage insurance premium is a bit more complicated. It is determined based on the loan amount, the length of the loan (15 or 30 years), and the loan-to-value (LTV) ratio—a measure that compares your mortgage amount to the actual worth of your home. This premium can range from 0.45% to 1.05% of the loan amount. Like the USDA annual fee, it is split into 12 installments and rolled into your mortgage payment each month.

How long you’ll pay this annual mortgage insurance premium varies based on your LTV ratio. Loans with an LTV ratio of 90% or less will only have to pay this annual insurance premium for 11 years. Those with an LTV ratio of more than 90% will pay the annual insurance premium for the lifetime of the loan.

Pictured: Urban Acres Agent Maria McCaw (right) at a closing with a GreenState Credit Union lender (left).

Pictured: Urban Acres Agent Maria McCaw (right) at a closing with a GreenState Credit Union lender (left).

National vs. Local Lenders

Not all mortgage types are created equal, and not all lenders are created equal. As important as it is to find the right loan type, it’s equally as important to work with the right lender.

At Urban Acres, we strongly advise our clients to work with local lenders. Here are a few reasons why!

1. You get personalized, face-to-face service.

Working with national lenders often means long hold times to talk with someone located across the country. Local lenders, on the other hand, are in your community. You can meet with an expert face-to-face and discuss your options to ensure you’re making the best financial decision.

Real estate stipulations can also differ from state to state and even from county to county. The whole process will be more efficient when you’re working with a local lender who is well-versed in Iowa’s real estate quirks and is familiar with customary transactions in Johnson, Linn, and surrounding counties.

When choosing between a national or local lender, ask yourself: Why leave the home of your dreams and your financial future in the hands of a financial advisor you’ve never met when you can get personalized service closer to home?

2. Local lenders can often offer more competitive rates than national lenders.

When you work with a local lender, you don’t just get a mortgage expert—you get someone who is an expert in your particular community. Rather than being based on national averages and trends, the rates offered by local lenders are based on what’s happening in the market in your area.

All of this local knowledge translates into a more customized and accurate offer—and potentially more savings in your future. In fact, at the time of publication, a few of the lenders in the greater Iowa City area are still offering 100% financing.

3. Your REALTOR® already knows them.

Over time, our REALTORS® have built relationships with the lenders in the area. If you choose to work with someone local, there’s a good chance that your Urban Acres agent will already know them. That prior history means your agent can help you find the right lender to work with—and can nudge your lender if necessary!

It’s also likely that your local lender will already know the other people involved in the transaction, from the attorney preparing the title work to the closing department. All of these interpersonal connections add up to create a cohesive network to support you during this major purchase.

4. Sellers will thank you.

If a home seller is looking at two fairly identical offers, the buyer using the local lender tends to win out and get the home. Why? Because sellers appreciate local, too. They don’t want the hassle of working with hard-to-reach national companies, either. If the buyer, lender, and agent are all located near one another, it makes for a smoother and faster transaction.

Let’s Get Started

Need a recommendation for a great lender to start the pre-approval process? Have more questions about your mortgage options? Reach out to your Urban Acres agent! They’ll put you in touch with a great local lender who can help.