Becoming a homeowner is one of life’s most exciting achievements. What many people don’t realize is that preparing to become a homeowner starts months—even years—before you officially begin your home search. The first step: laying a solid financial foundation.

That magic question, ’Can I afford to buy a home?’ is on every aspiring buyer’s mind. Whether it’s your first home buying journey or you’re a seasoned veteran, here are a few indicators you’re financially ready for this life-changing purchase.

1. You have a good credit score.

What qualifies as a good credit score? The term ‘good’ is pretty vague.

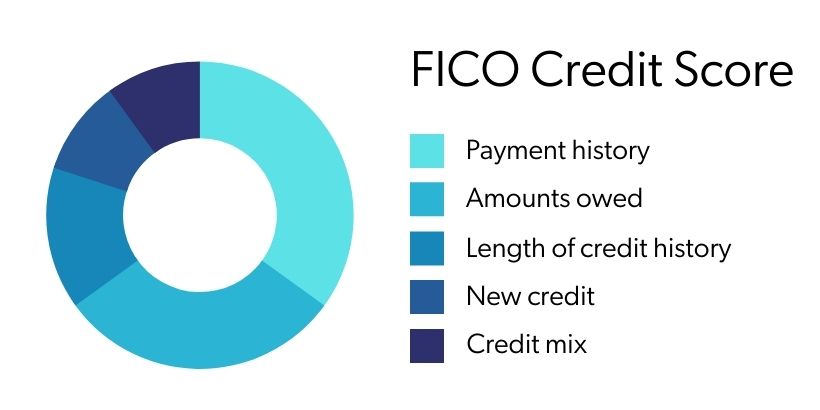

Before we discuss what credit score you should aim for, let’s back up and focus on how your credit score is calculated.

Image Credit: My Home by FreddieMac

How is credit score determined?

There are five factors that go into determining your FICO credit score:

- Payment History (35% of total credit score)

This component uses past payment behavior to predict your future payment behavior. It takes into account the ‘frequency, recency, and severity of reported missed payments.’ - Credit Utilization (30% of total credit score)

This is the percentage of available credit that’s been borrowed—in other words, how much of your credit you’re actually using. Maxing out credit cards regularly constitutes high credit utilization and will likely lower your credit score. - Length of Credit History (15% of total credit score)

This is the amount of time each account has been open and the amount of time since the account’s most recent activity. The longer your credit history, the more past activity FICO can take into account when predicting your future activity. This is why having no credit history does not usually equal a good credit score—with no history, FICO has no way of knowing what kind of borrower you’ll be. - New Credit (10% of total credit score)

This includes any new credit accounts you open. Open new credit accounts only as needed. Starting new accounts to improve your credit score is not a strategy financial experts recommend. In fact, credit inquiries—made every time you apply for a new line of credit—can actually hurt your credit score. - Credit Mix (10% of total credit score)

This represents the types of debt you have repaid. The three main types of credit are revolving, installment, and open credit. A mix of these three demonstrates to the lender that you can handle different types of credit debt.

How do you check your credit score?

Your credit score can change over time, so it’s a good idea to stay informed of where your current score stands.

Under the FACT Act, you are entitled to a free credit report once a year from each of the three credit bureaus—Equifax, Experian, and TransUnion. Visit annualcreditreport.com, an authorized website where you can receive your free report.

Note: Innovis is a secondary credit bureau you may encounter, but keep in mind they do not offer mortgage credit scores.

What counts as a ‘good’ credit score?

There is no magic number that constitutes a ‘good’ credit score. Even the big three credit bureaus don’t agree. TransUnion cites anything between 721–780 as good, whereas Equifax and Experian consider ‘good’ to be between 670–739.

It’s important to remember that a ‘good’ credit score will depend on the type of mortgage you’re exploring.

Credit Scores Required by Mortgage Loan Type

Different types of mortgages require different credit scores. That’s why there’s no single credit score number lenders are looking for. Generally, the better your credit score, the lower your interest rate for your mortgage loan.

Below we’ve listed some common mortgage types and the typical minimum FICO scores currently required, according to Bankrate.

- Conventional Loan: 620+ credit score

- FHA Loan: 500+ credit score (with a 10% down payment) or 580+ (with a 3.5% down payment)

- VA Loan: 620+ credit score (some lenders require 580)

- USDA Loan: 640+ credit score (some lenders require 580)

- Jumbo Loan: 700+ credit score

Check out our mortgage blog to learn more about each of these mortgage types.

How to improve your credit score

If your credit score is lower than you expected, don’t panic. Here are four ways you can address a low credit score and position yourself for the best mortgage rate.

- Report Mistakes

A Federal Trade Commission (FTC) study found that 26% of participants had a ‘potentially material error’ on their credit report. These errors can impact your credit score and therefore your ability to get approved for a mortgage. Report any errors you find in your credit report on the credit bureau website. - Pay More Than the Minimum

It’s always a good idea to make more than the minimum payment on your debts and pay the balance in full when possible. Not only will you avoid additional interest, but you’ll also tackle your balances faster. - Maintain Low Balances

You may have heard the golden rule that you should only use 30 percent of your credit limit, or your credit score will be punished. While this is a myth, it is still a good idea to keep your credit balances below 50 percent of your limit, and pay them off as soon as possible. - Avoid Closing Accounts

Once a credit account is paid off, it may be tempting to close the account. However, according to Equifax, if you close an account, it can actually hurt your credit score—even if that account had a $0 balance. This is because closing a line of credit lowers your total amount of available credit, therefore raising your utilization percentage—the amount of credit used compared to the amount available. That increase in utilization percentage negatively affects your credit score.

2. You’ve saved enough money for a down payment.

How much is enough? It depends.

What is a down payment?

A down payment is the money you pay to get a home loan. It represents your ownership stake in your future home and property.

Your down payment is a percentage based on the sale price of the home. For example, if you were purchasing a $300,000 home, a 3.5 percent down payment would be $10,500. On the other hand, a 20 percent down payment would be $60,000. For many homebuyers, especially first-time homebuyers, the second number can be more difficult to achieve.

Factors like the size of your loan, the type of mortgage you take out, interest rate, and private mortgage insurance (PMI) also influence how much your down payment will be.

Do you need to put 20% down?

Even if you’ve never purchased a home, you’ve probably heard the cardinal rule: Put at least 20 percent down. Why? Because it can lower your monthly mortgage payment, interest rate, and fees.

However, some finance experts say this is no longer the case. According to The Mortgage Reports, the average buyer now puts 13 percent down. For homebuyers younger than 30, that number is closer to 8 percent.

Still, the cardinal 20 percent rule exists for a reason. Let’s explore the pros and cons of putting 20 percent down.

Pros of Putting 20% Down

- Your monthly mortgage payment will be lower.

Putting 20 percent down means you only have 80 percent of the home left to pay off, which means smaller monthly mortgage payments. - You’ll have more equity in your home immediately.

A 20 percent down payment means you own 20 percent of your home right off the bat. You will continue to build equity in your home as you pay down your mortgage over the duration of the loan term. - You won’t have to pay private mortgage insurance (PMI).

Private mortgage insurance (sometimes called mortgage insurance) is an upfront fee built into your monthly mortgage payment. PMI isn’t intended to protect you as the buyer. Rather, it protects your lender if you default on your loan.

Generally, PMI is required for conventional loans where less than 20 percent is put down. A smaller down payment is a bigger risk to the lender because the lender is letting you borrow a larger amount. However, there are exceptions to this rule, so it’s worth having a conversation with your agent and your lender.

Once you have 20 percent equity in your home, PMI is no longer needed.

Cons of Putting 20% Down

- For many people, putting 20 percent down is simply not realistic.

Most people don’t have easy access to large amounts of cash, or liquid assets that can be turned into cash. This is where other sources of money like retirement funds (individual retirement account (IRA) and 401K), stocks and bonds, gifts, tax refunds, and security deposits come into play.

But depleting your financial safety net is generally not a good idea. Plus, if you drain your savings to make a down payment, you might not have enough to cover closing costs and other fees.

- Saving takes time.

If you’re determined to put 20 percent down, it might take years to save for your down payment. Rent can be costly, chipping away at what you’re able to save without allowing you to build up equity.

- You’re at risk if your home’s value drops.

In an economic downturn, a large down payment can leave you financially overexposed until the housing market recovers. In general, home values dip when the U.S. economy slumps, lowering your rate of return on your home if you made a larger down payment.

Down Payment Required by Mortgage Type

Here are the minimum down payments required for each mortgage type, according to Bankrate. For a more in-depth look at your mortgage loan options, check out this article.

- Conventional Loan: 3–5%

- FHA Loan: 3.5%

- VA Loan: 0% (but you will pay a one-time VA funding fee)

- USDA Loan: 0% (but you will pay an upfront and annual guarantee fee)

- Jumbo Loan: 10% (a larger loan is a bigger risk to the lender, so a larger upfront down payment is required)

3. You’ve been pre-approved by a mortgage lender.

The best way to learn if you’re financially ready to buy a home is to hear it from your lender.

What is a mortgage pre-approval?

A mortgage pre-approval is a stamp—or, in most cases, a letter—of approval from your lender. This document states that the lender has looked into your financial situation and determined roughly how much you can afford for a new home and how much they are willing to lend you to buy a home.

The lender will consider your credit score, your income, your savings, and many other factors to determine this number. In the process, they will also ascertain what type of mortgage loan makes sense for you.

Why is pre-approval important?

When you’ve found a home you love and are ready to put in an offer, a pre-approval letter is your golden ticket. This letter shows the seller that the bank has confirmed you can afford the home and that they will give you a loan. It allows the seller to take your offer more seriously. In fact, many sellers require a pre-approval letter before they’ll even consider an offer.

A pre-approval can also help you narrow down your parameters as you begin your home search. Once you know your estimated monthly payment with interest rates, property taxes, and insurance factored in, you’ll have a better idea how this payment will impact your overall budget.

Check out this article for more information on the pre-approval process and documentation you’ll need to provide to your lender.

The Bottom Line

Buying a home is one of the largest purchases you’ll make. You should feel prepared before taking the plunge!

Have questions? Need a recommendation for a local lender? Just reach out! Our REALTORS® are happy to talk to you about your home buying goals and how you can financially prepare to achieve them. When it’s time to start searching, they’ll also help you find homes within your budget.